At a famous performance by The Beatles at The Royal Variety Show at the Prince of Wales Theatre in London, in the presence of Queen Elizabeth II of England and Princess Margaret, an unrepentant John Lennon took the floor and addressed the audience:

“The people in the cheaper seats, clap your hands. And the rest of you, if you’d just rattle your jewelry.”

As the author of Working Class Hero suggested in 1963, in his own way, in Mexico’s recent electoral concert, big capital received the overwhelming triumph of Claudia Sheinbaum and the 4T candidates by rattling their jewels. They have ways of voting that do not go through the ballot box. One day after the elections, the Mexican Stock Exchange (BMV) plummeted 6.01.

The drop is the largest in the last four years. Not since the beginning of covid-19 has there been a loss of this magnitude. On the reason for this fall, Forbes quotes analyst Gabriella Siller: There is fear about Mexico, because Morena and its allies won the majority in Congress, which could lead to radical changes in the Constitution.

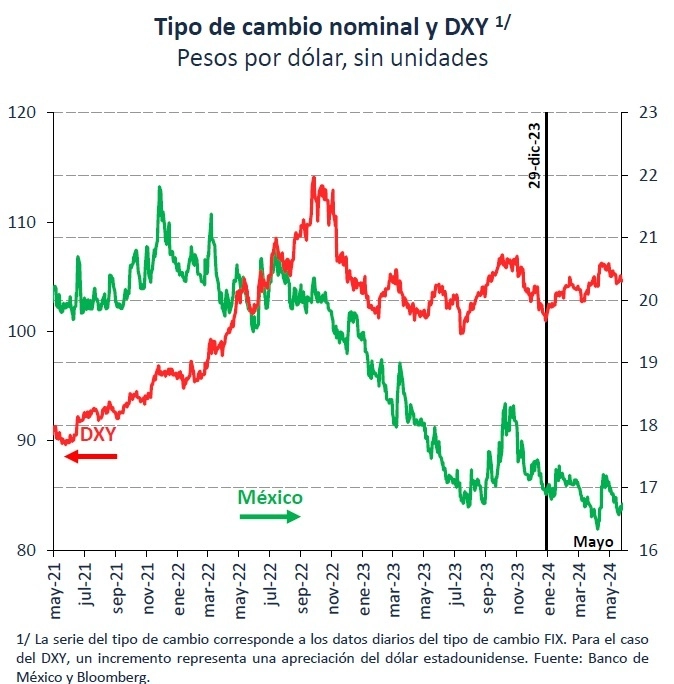

As a result of the stock market collapse, the peso depreciated, trading at 17.71 to the dollar, representing a 4.4 percent drop. The exchange rate’s Achilles heel is that four out of every five transactions with the Mexican currency are speculative.

And, as explained in Braulio Carbajal’s article in today’s La Jornada, in view of press reports that the next administration is analyzing fiscal changes to the banking sector, Banorte shares lost almost 15 percent, while Grupo Financiero Inbursa shares dropped 7.5 percent.

Interestingly, large corporations and entrepreneurs should not complain about the 4T. In 2023, banks maintained their historical profits. According to the National Banking and Securities Commission, the sector recorded a profit of 273,314 billion pesos that year. An increase of more than 10 percent in real terms, compared to the 237,321 billion pesos obtained in 2022. In five years, despite the pandemic, these banks obtained 958,702 million pesos. In the first quarter of 2024, they did not do badly. They earned 68 billion 334 million pesos.

At the closing of the 87th Banking Convention in Acapulco, in which President Andrés Manuel López Obrador said an early farewell to the bankers, the President told them: You have treated me very well, with respect, and I believe you have been reciprocated. In turn, the money lords thanked the Chief Executive for not having changed the rules of the sector, fulfilling what he offered in 2019.

Nor have big businessmen fared badly during the 4T. According to Oxfam, there are 293,980 people in Mexico with more than one million dollars. They account for 60 pesos out of every 100 pesos of private wealth.

According to Bloomberg, since Tabasqueño (López Obrador) took office at the end of 2018, the wealth of the five richest men in Mexico doubled that of the rest of Latin Americans. In fact, the dominant market share they have in their economic sectors was not reduced. In the words of the global movement to fight poverty and inequality, this has allowed them to take advantage of the economic shocks following the recent global crises to increase their profits by raising the prices of products in the sectors they control more than prices in the Mexican economy as a whole.

Oxfam documented how the profits of the 14 richest people in Mexico have grown. The ultra-rich (those with more than $1 billion) have doubled their fortunes. They account for 8.18 out of every 100 pesos of the nation’s private wealth: 180 billion dollars.

Three examples. Carlos Slim ranks 12th of the 500 richest people in the world (107 billion dollars). Germán Larrea, second in Mexico and 31st internationally (41.5 billion dollars). In third place in Mexico and 134th on a global scale, Ricardo Salinas Pliego, with 15.3 billion dollars.

Why then this response from the financial world? Some alarm signals have been raised in the economic outlook. Analysts have pointed out that the peso is overvalued. The Bank of Mexico reduced the economy’s growth expectations for this year, for the second consecutive quarter, from 2.8 percent to 2.4 percent. It maintained its forecast for 2025 of only 1.5 percent. The country’s domestic debt grew since 2018 by 35 percent in real terms. Meanwhile, public debt per capita rose 7 percent in real terms. This year there will be high fiscal deficit: 5.9 percent of GDP.

The Ministry of Finance called for shielding the Mexican economy from external shocks that are approaching: presidential elections in the United States; the Washington and Beijing trade conflict; high interest rates, and geopolitical disputes.

Part of the private sector assures that the main problem that the next government will face is the unsustainability of public finances. Although as a candidate Sheinbaum announced that she would not make a tax reform to tax capital, the promise to extend social programs and finish (and start) large public works, require additional economic resources. Without collecting more taxes, the only option is to take on debt.

Financial circles are not at ease with the electoral results. They give Morena and its allies carte blanche to push for profound reforms, with which they do not agree. Hence, beyond the ballot box, they have decided to vote with their jewelry.

Original article by Luis Hernández Navarro, La Jornada, June 4th, 2024.

Translated by Schools for Chiapas.